Credit Freeze Is All You Need

I’ve recently been exploring finance and investing topics and stumbled upon a serious issue: identity theft. Essentially, someone can use your Social Security Number (SSN) to open credit cards, rack up charges, and ruin your credit score. Because this is such a serious problem, I wanted to learn how to protect my credit and share what I’ve found.

All the content here is learned from University of Reddit.

The biggest worry about identity theft is that thieves could use your SSN to open new credit cards or even car loans without you knowing. To protect yourself, a solid strategy is to freeze your credit with the three major credit reporting agencies.

- Freezing your credit stops banks and lenders from doing a “hard pull” on your credit report. This means credit reporting agencies will deny any new credit report inquiry, causing banks and lenders to reject fraudulent requests made by thieves.

- Freeze your credit does not stop your credit to go up and down, you are still responsible for managing your debt.

Here’s what you can do to protect your credit:

- Get a free copy of your credit report every 12 months from Annual Credit Report. Check it for any signs of identity theft.

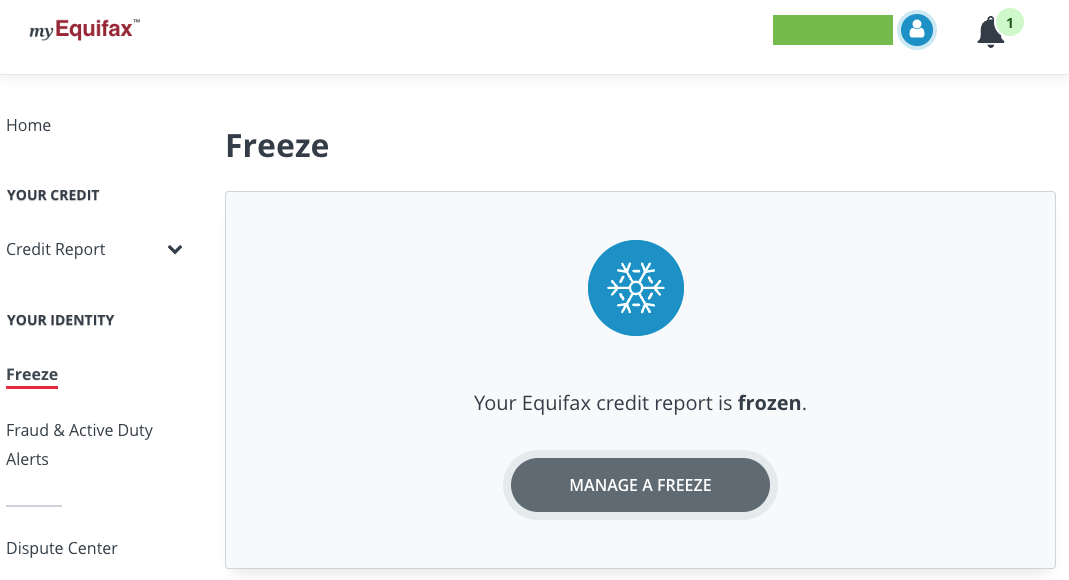

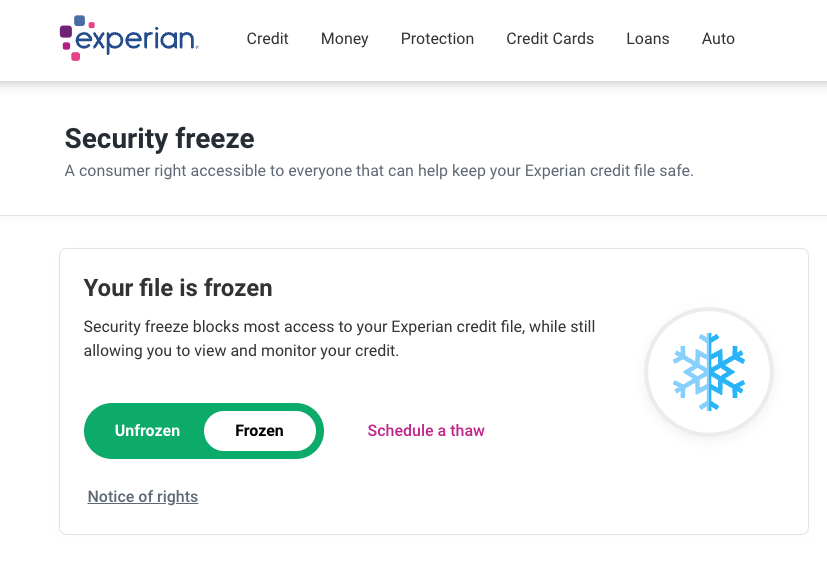

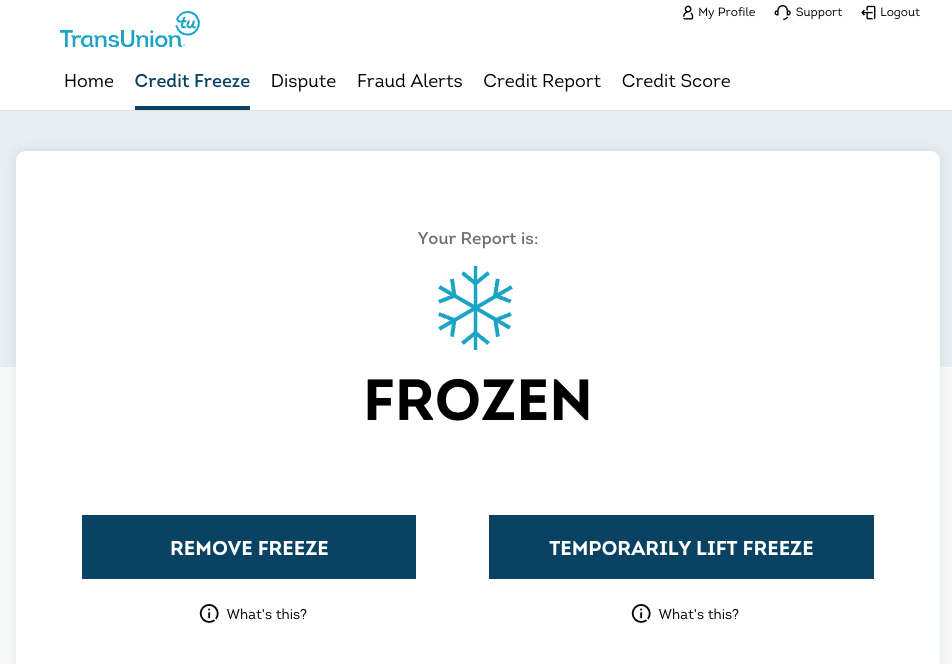

- You can freeze your credit for free at the three major Consumer Credit Reporting Agencies—Experian, TransUnion, and Equifax. It’s easy to do directly on their websites, and you can unfreeze it just as quickly when needed. Think of it as a simple on/off switch.

- Be cautious as these agencies often push paid services. Remember, creating an account, checking your credit history, and freezing your credit are all free. If you find yourself paying for basic services, you might have been misled by their website design.

For a comprehensive list of protective measures, check out r/IdentityTheft. But in my opinion, while you can take many steps to safeguard your credit, simply freezing it is usually enough without complicating your life too much.

After doing all this research, here are the simplest and most effective strategies I recommend for managing credit in the United States:

- Always use credit cards, and use them wisely, to build a good credit history. Make sure to pay on time and pay in full.

- Check your credit report yearly for any unusual activities.

- Keep your credit frozen with the three major agencies and only unfreeze it when you need to apply for a new credit card or a loan. (Personally, I’m not a fan of car loans, there is no reason to drive a car you cannot afford, or even use a phone you cannot afford, but that’s just me.)